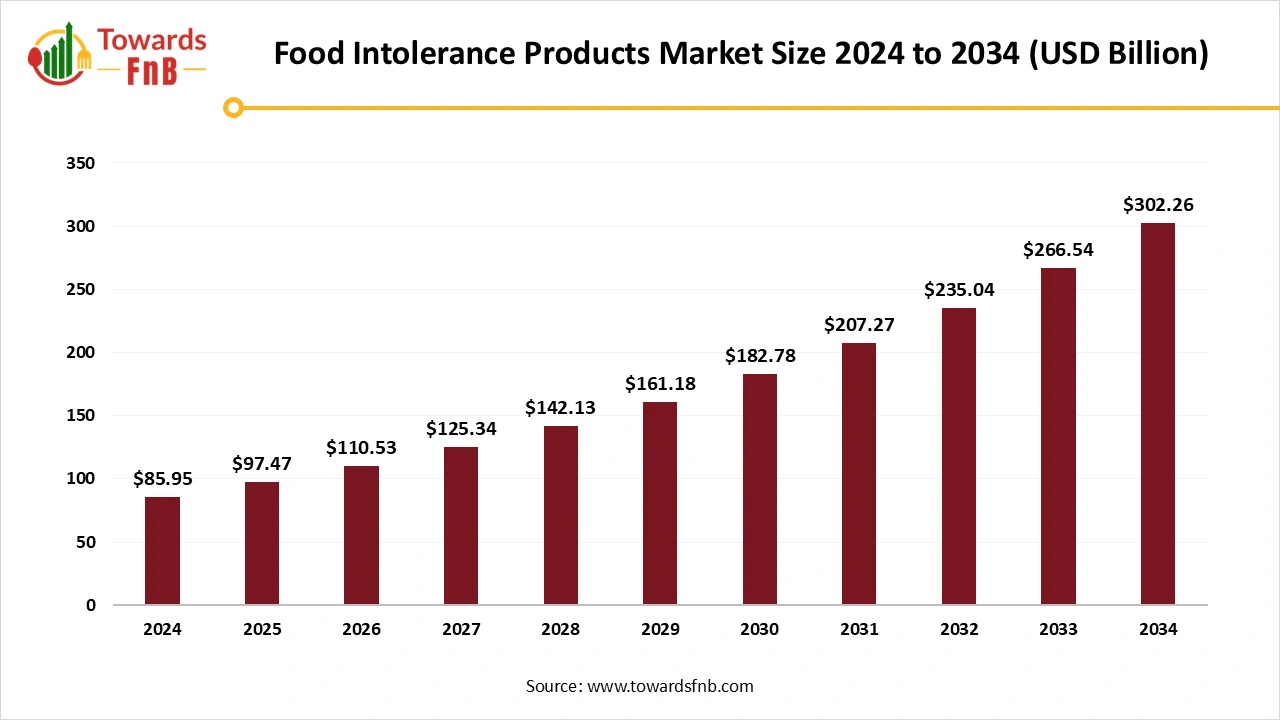

Food Intolerance Products Market Size Expected to Grow USD 302.26 Billion by 2034, Fueled by Increased Health Awareness

According to Towards FnB, the global food intolerance products market size is set to grow significantly, starting at an estimated USD 97.47 billion in 2025. By 2034, this market is expected to nearly triple in size, reaching USD 302.26 billion, fueled by an impressive compound annual growth rate (CAGR) of 13.4% throughout the forecast period.

Ottawa, Aug. 22, 2025 (GLOBE NEWSWIRE) -- The global food intolerance products market size stood at USD 85.95 billion in 2024 and is predicted to rise form USD 97.47 billion in 2025 to around USD 302.26 billion by 2034, expanding at a CAGR of 13.4% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market is observing a spike in recent periods due to rising issues like food allergies and intolerance to gluten, dairy, and various other substances. Rising numbers of celiac disease are also a major factor in the growth of the food intolerance products market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5548

Food Intolerance Products Market Overview

The food intolerance products market is expanding rapidly due to the rising number of individuals with different types of food allergies, such as gluten, lactose, or celiac disease. Hence, to cater to the needs of such issues, the food intolerance market consists of products and food items free from such substances, helpful to avoid any health issues in this sector of the population. Higher demand for clean-label products and healthy products for the body is also helping the growth of the market. An increased number of sales channels in the form of physical and online platforms is also helping the growth of the market. Technological advancements helpful to maintain the taste and texture of clean-label foods similar to conventional foods are also helping the growth of the food intolerance products market.

Key Highlights of the Food Intolerance Products Market

- By region, Asia Pacific Led the food intolerance products market in 2024, whereas North America is expected to grow in the foreseeable period.

- By product type, the dairy alternatives and lactose-free products segment dominated the market in 2024, whereas the bakery products segment is expected to grow in the foreseeable period.

- By intolerance, the dairy and lactose intolerance segment held the largest share in 2024, whereas the meat intolerance segment is expected to grow in the foreseeable period.

- By category, the conventional segment dominated the market in 2024, whereas the organic segment is expected to grow in the forecast period.

- By distribution channel, the supermarkets/hypermarkets segment led the food intolerance products market in 2024, whereas the online retail segment is expected to grow in the forecast period.

Emerging Trends in the Food Intolerance Products Market

- Availability of clean-label foods in the form of ready-to-eat products is helping the growth of the food intolerance products market. High demand by consumers for a convenient lifestyle is helping the growth of the market.

- High demand for personalized diets to meet the needs of personal body requirements is also helping the growth of the market. It helps to target the physical needs and heal the issues in a quicker time.

- Technological advancements in the form of smart food packaging, which are helpful to maintain the nutritional quality of food, are also helping the growth of the food intolerance products market. It helps to maintain the shelf-life of food, along with helping to maintain its nutritional value.

How Has AI Transformed the Food Intolerance Products Market?

Artificial intelligence (AI) is playing a transformative role in the food intolerance products market by driving personalization, innovation, and operational efficiency. One of the key benefits of AI is its ability to analyze vast datasets from medical research, consumer dietary habits, and genetic information to develop highly personalized food intolerance solutions, such as gluten-free, lactose-free, or nut-free products. This personalization helps consumers with specific intolerances find products that match their nutritional needs without compromising taste or variety. AI also accelerates research and development by predicting ingredient interactions, testing alternative formulations, and identifying emerging intolerance-related health trends, allowing manufacturers to bring innovative products to market faster.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-intolerance-products-market

Recent Developments in the Food Intolerance Products Market

- In March 2025, Instacart launched AI-backed tools to allow consumers to select their dietary preferences while shopping for groceries to get a personalized list of products. The tool includes 14 dietary preference options, including gluten-free, low-calorie, and even pescatarian food options for consumers. (Source- https://www.fiercehealthcare.com)

- In February 2025, PlantBaby, a US food tech startup, secured $4M to expand the reach of its plant-based milk, Kiki Milk for kids. The financing was led by B2 Partners at a post-money valuation of $20M. (Source- https://www.greenqueen.com.hk)

Market Dynamics

What are the Growth Drivers of the Food Intolerance Products Market?

There are multiple factors helping the growth of the market for food intolerance products, such as rising prevalence of food allergies, changing dietary preferences, and high demand for clean-label products. The market provides food options for people sensitive to certain food substances and those who are suffering from issues such as celiac disease or dairy intolerance. Rising awareness about health and wellness, and the rising number of health-conscious people, are also helping to boost the growth of the market. Government regulations regarding guidelines for allergen labelling, which are helpful for consumers to choose the right product, are also helping the growth of the market.

Challenge

High Production Costs and Limited Awareness are Hampering the Growth of the Market.

High costs of raw materials involved for making clean-label products free from different types of allergens, such as wheat, lactose, and other allergens affecting the health of many, is one of the issues hampering the growth of the market. The issue eventually leads to high prices of the final product as well. Hence, many consumers do not prefer to shop for such products, further hampering the growth of the food intolerance products market. Many consumers aren’t aware of their dietary preferences for their body, hence such issues also restrict the growth of the food intolerance products market.

Opportunity

Product Innovation in Food Processing is Helping the Growth of the Market in the foreseeable period.

Product innovation with the help of advanced technology in the food processing segment is helping the growth of the food intolerance products market. Consumers suffering from high sugar levels can enjoy different types of sweeteners available in the market today, made from different kinds of digestible fiber and natural sugars. Innovation has also made it possible to form lactose-free dairy products such as dairy-free cheese, yoghurt, and milk. Hence, such innovation helps the market to grow in the foreseen period.

Food Intolerance Products Market Regional Analysis

Asia Pacific led the Food Intolerance Products Market in 2024

Rising demand for clean-label and allergen-free food options is helping the growth of the market in the region. The rising prevalence of different types of health issues in the region, fuelling demand for functional food and ingredients, is also helping the growth of the market for food intolerance products in the Asia Pacific. Hence, to fuel the specialized needs of such consumers is helping the growth of the market in the region. India has a huge contribution to the growth of the market in the region due to a high percentage of the population suffering from food allergy issues and celiac disease, which is helpful for the growth of the market.

North America Is Expected to Grow in the Forecast Period

North America is expected to grow in the foreseen period due to the rising population of consumers demanding allergen-free food items due to their dietary preferences. Increasing consumer awareness about health and wellness is also helping the growth of the market in the foreseeable period. The US plays a major role in the growth of the market in the region due to the increasing population of health-conscious consumers with certain lifestyle changes demanding clean-label products as per their dietary preferences.

Food Intolerance Products Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 13.4% |

| Market Size in 2024 | USD 85.95 Billion |

| Market Size in 2025 | USD 97.47 billion |

| Market Size by 2034 | USD 302.26 billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Intolerance Products Market Segmental Analysis

Product Type Analysis

Why Has the Dairy Alternatives and Lactose-Free Products Segment Dominated the Food Intolerance Products Market in 2024?

The dairy-alternatives and lactose-free products segment led the food intolerance products market in 2024 due to high demand for dairy-free products, as they form a major base in an individual’s regular diet. Dairy products such as milk, cheese, yoghurt, and butter are some of the essentials, and hence their lactose-free variations are high in demand by vegans and by lactose intolerants. The rising population of vegans and consumers following a plant-based diet and the rising number of lactose intolerants are also helping the growth of the food intolerance products market.

The bakery products segment is expected to grow in the foreseeable period due to high demand for bakery product free from gluten, lactose, sugar, and other allergens. Hence, bakery items such as cakes, breads, cookies, pastries, and muffins, free from such allergens, are helping the growth of the market. Convenient food options made from allergen-free ingredients are also fuelling the growth of the food intolerance products market in the foreseeable period.

Intolerance Analysis

Why Has the Dairy and Lactose Intolerance Segment Led the Food Intolerance Products Market?

The dairy and lactose intolerance segment dominated the food intolerance products market in 2024 due to the rising population of lactose intolerants and vegans, along with people following plant-based diets. Hence, an increase in the population of such consumers is leading to the growth of dairy alternatives and lactose-free food options. Such functional foods help to provide the nutritional requirements and help to fuel the growth of the market.

The meat intolerance segment is expected to grow in the foreseeable period due to rising meat intolerance observed among consumers globally. Hence, the meat alternatives made from plant-based ingredients are helping the growth of the market in the foreseeable period, further fuelling the growth of the market. The manufacturers ensure to provide a similar taste and texture of meat in the plant-based alternative to maintain the sales of the product and contribute to the growth of the food intolerance products market.

Category Analysis

Why Has the Conventional Segment Led the Food Intolerance Products Market in 2024?

The conventional segment dominated the food intolerance products market in 2024 due to its widespread availability, economic prices, and high demand by a major chunk of the population comprising consumers of different age groups. Such food items are easily available on different platforms, fueling the market’s growth.

The organic segment is expected to grow in the foreseen period due to factors such as rising consumer demand for clean-label foods, a rising number of vegans and plant-based diet followers, and other similar reasons. The rising awareness about sustainability, fuelling demand for foods made by following sustainable methods, is also helping the growth of the market. High awareness regarding organic foods, helpful for gut health, is also helping the growth of the food intolerance products market.

Distribution Channel Analysis

Why Has the Supermarkets/Hypermarkets Segment Led the Food Intolerance Products Market in 2024?

The supermarkets/hypermarkets segment dominated the food intolerance products market in 2024 due to their high availability in residential areas, which is helpful for consumers to purchase various products. Such platforms have different types of conventional and organic food options according to the dietary preferences of consumers. Proper display of products and dedicated sections of different types of products helped the growth of the market in 2024.

The online retail segment is expected to grow in the foreseeable period due to the convenience provided by the platform to allow consumers to get their desired products at their doorstep within a few minutes. Such platforms allow consumers to browse through various products, gain knowledge about each product, and order the best one as per their dietary preferences. Hence, the segment is observed to grow in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Organic Food Market: The global organic food market size was calculated at USD 228.38 billion in 2024 and is expected to grow steadily from USD 253.96 billion in 2025 to reach nearly USD 660.25 billion by 2034, growing at a CAGR of 11.20% over the forecast period from 2025 to 2034.

- Dietary Supplements Market: The global dietary supplements market size was reached at USD 192.68 billion in 2024 and is predicted to increase from USD 210.41 billion in 2025 to USD 464.58 billion by 2034, with an expected CAGR of 9.2% during the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size reached at USD 18.70 billion in 2024 and is expected to grow steadily from USD 20.33 billion in 2025 to reach nearly USD 43.07 billion by 2034, with a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Non-Alcoholic Beverages Market: The global non-alcoholic beverages market size reached at USD 1,308 billion in 2024 and is anticipated to increase from USD 1,406 billion in 2025 to an estimated USD 2,696 billion by 2034, witnessing a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Frozen Food Market: The global frozen food market size reached USD 203.15 billion in 2024 and is projected to grow from USD 214.32 billion in 2025 to nearly USD 347.01 billion by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Dry Fruit Market: The global dry fruit market size reached USD 7.10 billion in 2024 and is expected to grow steadily from USD 7.47 billion in 2025 to reach nearly USD 11.79 billion by 2034, expanding at a CAGR of 5.20% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size was valued at USD 165.28 billion in 2024, and is expected to grow steadily from USD 173.71 billion in 2025 to reach nearly USD 271.80 billion by 2034, with a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size was calculated at USD 20.22 billion in 2024 and is anticipated to increase from USD 22.38 billion in 2025 to an estimated USD 55.88 billion by 2034, witnessing a CAGR of 10.7% during the forecast period from 2025 to 2034.

Leading Companies in the Food Intolerance Products Market

- Conagra Brands Inc.

- Hain Celestial Group Inc.

- Amy's Kitchen Inc.

- Monde Nissin

- Arla Foods Amba

- Dr. Schär

- Ecotone

- General Mills Inc.

- Chobani LLC

- Danone SA

- Doves Farm Foods Ltd

Segments Covered in the Report

By Product Type

- Dairy Alternatives and Lactose free products

- Bakery Products

- Chocolates and Confectionary

- Meat Alternatives

- Specialized Nutrition

- Snacks and Processed food

- Condiments and Dressings

By Intolerance Type

- Dairy and Lactose Intolerance

- Sugar Intolerance

- Gluten Intolerance

- Meat Intolerance

By Category

- Organic

- Conventional

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience stores

- Online Retail

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5548

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️ Sugar-Free Food Market: https://www.towardsfnb.com/insights/sugar-free-food-market

➡️ Snack Food Market: https://www.towardsfnb.com/insights/snack-food-market

➡️ Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️ Confectionery Market: https://www.towardsfnb.com/insights/confectionery-market

➡️ Personalized Nutrition Market: https://www.towardsfnb.com/insights/personalized-nutrition-market

➡️ Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️ Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️ Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️ Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️ Smoothie Market: https://www.towardsfnb.com/insights/smoothie-market

➡️ Pet Food Market: https://www.towardsfnb.com/insights/pet-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.