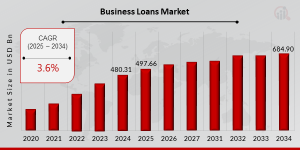

Business Loans Market Size to Reach USD 684.90 Billion by 2034, Growing at a CAGR of 3.60% | Industry Trends

Business Loans Market Research Report By, Loan Type, Loan Purpose, Interest Rate Type, Lender Type, Regional

NH, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- The global Business Loans market has shown steady growth in recent years and is set to expand further over the coming decade. In 2024, the market size was valued at USD 480.31 billion and is projected to grow from USD 497.66 billion in 2025 to USD 684.90 billion by 2034, reflecting a moderate compound annual growth rate (CAGR) of 3.60% during the forecast period (2025–2034). This growth is primarily driven by rising demand for SME financing, expanding infrastructure investments, and the growing adoption of digital lending platforms.Key Drivers of Market Growth

1. Growing Demand from SMEs- Small and medium-sized enterprises (SMEs) continue to be a major growth driver for the business loans market. These businesses require financing for working capital, expansion, and operational needs, leading to increased borrowing activity worldwide.

2. Digital Transformation in Lending- The rise of online lending platforms and fintech solutions has streamlined loan applications, credit assessments, and disbursements, making business financing faster and more accessible.

3. Government Support and Funding Programs- Governments across various regions are implementing policies, subsidies, and guarantee schemes to support businesses, especially in sectors affected by economic downturns, thereby boosting loan demand.

4. Infrastructure and Industrial Growth- Global infrastructure development and industrial expansion are driving the need for long-term financing solutions, further strengthening the business loans market.

5. Diversification of Loan Products- Financial institutions are offering customized loan products, flexible repayment terms, and sector-specific financing solutions to attract a broader range of borrowers.

Get a FREE Sample Report - https://www.marketresearchfuture.com/sample_request/23967

Key Companies in the Business Loans Market Include:

• Bank of America Corporation

• JPMorgan Chase & Co.

• Wells Fargo & Company

• Citigroup Inc.

• HSBC Holdings plc

• BNP Paribas

• Mitsubishi UFJ Financial Group

• Barclays Bank plc

• Goldman Sachs Group, Inc.

• UBS Group AG

• Royal Bank of Canada

• ICICI Bank Limited

• State Bank of India

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/business-loans-market-23967

Market Segmentation

To provide a detailed analysis, the Business Loans market is segmented by loan type, enterprise size, end-use, and region.

1. By Loan Type

• Term Loans

• Working Capital Loans

• Invoice Financing

• Equipment Financing

• Merchant Cash Advances

2. By Enterprise Size

• Small Enterprises

• Medium Enterprises

• Large Enterprises

3. By End-Use

• Expansion & Growth

• Inventory Purchase

• Equipment Acquisition

• Debt Restructuring

4. By Region

• North America: Strong market with high penetration of digital lending platforms.

• Europe: Growth supported by SME funding and government-backed loan schemes.

• Asia-Pacific: Fastest-growing region driven by emerging economies like China and India.

• Rest of the World: Increasing adoption in Latin America, Middle East, and Africa.

Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23967

The global Business Loans market is poised for steady expansion, supported by SME financing needs, government initiatives, and the digitalization of lending services. As businesses seek faster, more flexible funding solutions, lenders that innovate and adapt to market changes are expected to gain a competitive edge in the coming years.

Top Trending Research Report :

Home Equity Lending Market - https://www.marketresearchfuture.com/reports/home-equity-lending-market-24495

Leasing Market - https://www.marketresearchfuture.com/reports/leasing-market-24472

Micro Lending Market - https://www.marketresearchfuture.com/reports/micro-lending-market-24501

Msme Financing Market - https://www.marketresearchfuture.com/reports/msme-financing-market-24458

Mutual Fund Asset Market - https://www.marketresearchfuture.com/reports/mutual-fund-asset-market-23647

Peer To Peer Lending Market - https://www.marketresearchfuture.com/reports/peer-to-peer-lending-market-24505

Insurance Claims Market - https://www.marketresearchfuture.com/reports/insurance-claims-market-24563

Life And Annuity Insurance Market - https://www.marketresearchfuture.com/reports/life-annuity-insurance-market-24566

Life And Non-Life Insurance Market - https://www.marketresearchfuture.com/reports/life-and-non-life-insurance-market-24573

Life Reinsurance Market - https://www.marketresearchfuture.com/reports/life-reinsurance-market-24580

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.