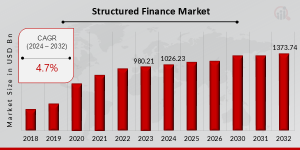

Structured Finance Market Size to Reach USD 1,373.74 Billion by 2032 | CAGR of 4.70% Forecasted (2024-2032)

Structured Finance Market Research Report By, Security Type, Underlying Asset Class, Tranche, Rating, Purpose, Regional

TN, UNITED STATES, August 13, 2025 /EINPresswire.com/ -- The global Structured Finance Market is poised for steady growth over the coming years. Estimated at USD 980.21 billion in 2023, the market is expected to expand from USD 1,026.23 billion in 2024 to USD 1,373.74 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of approximately 4.7% during the forecast period from 2024 to 2032. Increasing demand for diversified financial products, enhanced risk management strategies, and evolving regulatory frameworks are driving the growth of the structured finance industry.Key Drivers of Market Growth

Growing Demand for Risk Mitigation and Capital Optimization

Structured finance solutions enable institutions to manage credit risks and optimize capital allocation efficiently. This is particularly important for banks and financial institutions aiming to meet regulatory capital requirements while maintaining liquidity.

Expansion of Securitization Activities

The rise in securitization transactions, including mortgage-backed securities (MBS), asset-backed securities (ABS), and collateralized loan obligations (CLOs), is significantly boosting the structured finance market.

Technological Advancements and Digital Platforms

Adoption of advanced analytics, blockchain, and automation technologies in structured finance processes is enhancing transparency, reducing operational risks, and improving transaction efficiency.

Regulatory Developments

Evolving regulations focused on financial stability and risk mitigation are encouraging the adoption of structured finance products as viable tools for risk transfer and capital management.

Get a FREE Sample Report - https://www.marketresearchfuture.com/sample_request/24695

Key Companies in the Structured Finance Market Include:

• JPMorgan Chase & Co.

• Citigroup Inc.

• Goldman Sachs Group Inc.

• Bank of America Merrill Lynch

• Barclays PLC

• Deutsche Bank AG

• Credit Suisse Group AG

• Wells Fargo & Company

• Morgan Stanley

• BNP Paribas

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/structured-finance-market-24695

Market Segmentation

The structured finance market is segmented based on product type, end-user, and region.

1. By Product Type

• Asset-Backed Securities (ABS)

• Mortgage-Backed Securities (MBS)

• Collateralized Debt Obligations (CDOs)

• Collateralized Loan Obligations (CLOs)

• Others (Credit Derivatives, Synthetic Securitization)

2. By End-User

• Banks and Financial Institutions

• Insurance Companies

• Pension Funds

• Hedge Funds

• Government Entities

3. By Region

• North America: Largest market with mature securitization markets and robust regulatory frameworks.

• Europe: Growth driven by regulatory reforms and expansion of securitization activity.

• Asia-Pacific: Emerging region with increasing adoption of structured finance products.

• Rest of the World: Developing markets showing gradual uptake of structured finance solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24695

The structured finance market is on a consistent growth path supported by the demand for innovative risk management and capital optimization instruments. As financial markets evolve, the structured finance industry will continue to offer critical solutions to institutions aiming for financial resilience and operational efficiency worldwide.

Related Research Report:

Compulsory Third Party Insurance Market - https://www.marketresearchfuture.com/reports/compulsory-third-party-insurance-market-23867

Credit Intermediation Market - https://www.marketresearchfuture.com/reports/credit-intermediation-market-23877

Final Expense Insurance Market - https://www.marketresearchfuture.com/reports/final-expense-insurance-market-23889

Financial Consulting Software Market - https://www.marketresearchfuture.com/reports/financial-consulting-software-market-23902

Fine Art Insurance Market - https://www.marketresearchfuture.com/reports/fine-art-insurance-market-23912

Hedge Funds Market - https://www.marketresearchfuture.com/reports/hedge-funds-market-23921

Investor Esg Software Market - https://www.marketresearchfuture.com/reports/investor-esg-software-market-23872

Mpos Terminals Market - https://www.marketresearchfuture.com/reports/mpos-terminals-market-23919

Open Banking Systems Market - https://www.marketresearchfuture.com/reports/open-banking-systems-market-23891

Charge Card Market - https://www.marketresearchfuture.com/reports/charge-card-market-23906

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.