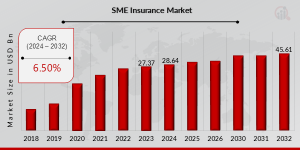

SME Insurance Market Size to Reach USD 45.61 Billion by 2032 | CAGR of 6.50% Projected (2024-2032)

SME Insurance Market Research Report By, Coverage Type, Business Size, Industry, Geographic Reach, Regional

PA, UNITED STATES, August 13, 2025 /EINPresswire.com/ -- The global Small and Medium Enterprise (SME) Insurance Market is witnessing steady growth and is expected to expand significantly over the coming years. In 2023, the market size was valued at USD 27.37 billion and is forecasted to grow from USD 28.64 billion in 2024 to USD 45.61 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of approximately 6.50% during the forecast period from 2024 to 2032. The rising focus on risk management among SMEs, increasing regulatory compliance, and tailored insurance products are key factors propelling this market forward.Key Drivers of Market Growth

Rising Awareness of Risk Management Among SMEs

Small and medium enterprises are increasingly recognizing the importance of insurance to protect against operational risks, business interruptions, and liability issues. This awareness is driving adoption rates globally.

Regulatory and Compliance Requirements

Government regulations and industry standards in many countries mandate certain types of insurance coverage for SMEs, contributing to steady demand.

Customized Insurance Solutions

Insurance providers are developing specialized products tailored to the unique needs of SMEs, such as cyber insurance, business interruption, and liability insurance, making coverage more accessible and relevant.

Technological Adoption and Digital Platforms

Digital insurance platforms and insurtech innovations have simplified policy management and claims processing, making insurance more attractive to SMEs by enhancing convenience and reducing costs.

Get a FREE Sample Report - https://www.marketresearchfuture.com/sample_request/24599

Key Companies in the SME Insurance Market Include:

• AIG

• AXA XL

• Chubb Limited

• Allianz SE

• Zurich Insurance Group

• The Hartford

• Tokio Marine Holdings

• CNA Financial Corporation

• CNA Insurance

• Hiscox Ltd

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/sme-insurance-market-24599

Market Segmentation

The SME insurance market is segmented based on insurance type, enterprise size, and region.

1. By Insurance Type

• Property Insurance

• Liability Insurance

• Workers’ Compensation Insurance

• Health Insurance

• Cyber Insurance

• Business Interruption Insurance

2. By Enterprise Size

• Micro Enterprises

• Small Enterprises

• Medium Enterprises

3. By Region

• North America: Mature market with a high concentration of SMEs and strong insurance penetration.

• Europe: Growth driven by regulatory mandates and digital insurance adoption.

• Asia-Pacific: Rapidly growing region fueled by increasing SME establishments and rising insurance awareness.

• Rest of the World: Emerging markets with untapped SME insurance potential.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24599

The SME insurance market is on a promising growth path, supported by increasing risk awareness, regulatory pressures, and advancements in digital insurance solutions. As SMEs seek to safeguard their operations amid evolving risks, the demand for flexible and comprehensive insurance offerings will continue to rise, presenting lucrative opportunities for insurers worldwide.

Related Research Report:

Umbrella Insurance Market - https://www.marketresearchfuture.com/reports/umbrella-insurance-market-22580

Cryptocurrency Exchange Platform Market - https://www.marketresearchfuture.com/reports/cryptocurrency-exchange-platform-market-22319

Takaful Insurance Market - https://www.marketresearchfuture.com/reports/takaful-insurance-market-22709

Community Banking Market - https://www.marketresearchfuture.com/reports/community-banking-market-23687

Asset-Backed Securities Market - https://www.marketresearchfuture.com/reports/asset-backed-securities-market-23890

Balanced Funds Market - https://www.marketresearchfuture.com/reports/balanced-funds-market-23875

Bancassurance Market - https://www.marketresearchfuture.com/reports/bancassurance-market-23854

Bank Guarantee Market - https://www.marketresearchfuture.com/reports/bank-guarantee-market-23861

Banking BPS Market - https://www.marketresearchfuture.com/reports/banking-bps-market-23871

Banking Market - https://www.marketresearchfuture.com/reports/banking-market-23852

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.